Experienced advisor Joshua has been in the trenches virtually for over 10 years.

And his story of success, failure, ups, downs, and life challenges will inspire you and give you a new perspective on selling annuities (virtually).

Previously, he built a successful practice using college planning seminars and IUL leads programs…

…until he stumbled upon a fresh new approach to marketing and selling annuities.

But, here’s the problem, most advisors were using dinner seminars and retirement workshops and Joshua didn’t like the idea of running equipment across town, or driving to clients’ homes to close business.

Our industry is fraught with “bait & switch” tactics and marketing gimmicks in an attempt to sell more annuities (because that’s what most advisors are being told to do by their FMO).

Joshua abandoned college planning and an IUL leads program because he was frustrated and burned-out with the inefficiency of using “backdoor” tactics to sell annuities.

Joshua didn’t want to revert back to more traditional methods like dinner seminars or educational classes at universities, and the idea of dragging equipment across town, feeding people at fancy restaurants, working nights and weekends, then driving across town to close leads, was a no-go.

So when Joshua found a way to sell annuities “virtually” with no seminars, no college planning programs, or buying IUL leads, he went all-in (way before everyone else considered a “virtual” practice).

And that’s when AIM came into the picture. I had my first conversation with Joshua a couple of years ago and was immediately impressed because he was one of the few industry trailblazers when it comes to virtual selling.

Joshua has a frank and candid style that you don’t see much in our industry.

His unique approach and battle-tested virtual sales methods have stood the test of time and are a valuable resource for any advisor looking to write more business.

After successfully using college planning and joining an IUL leads program, Joshua was looking for a more direct approach to attract more qualified annuity prospects.

Fast forward to today, Joshua has continued to successfully grow his practice and wants to pay it forward by sharing his wisdom and experience with other advisors that want to learn virtual selling.

Which is why Joshua is our featured guest on this episode of the Annuity Experts Show.

Joshua has a unique style and approach to selling annuities any advisor will want to hear.

He’s a no-frills kind of guy and likes to keep it direct and honest.

Which is what makes Joshua’s story so unique.

However, there is more to Joshua’s story than just selling annuities.

Here are some interesting facts about him:

- Joshua spent years as a funeral director before he became an advisor.

- Joshua spent years to attain his Rabbinic Studies degree (which is a feat in and of itself).

- Joshua nearly died after a life-threatening brain hemorrhage that left him in a coma and ultimately changed his perspective on life.

- Joshua has closed 4M in annuity business YTD, and is on pace to hit 5-6M by the end of the year (without any in-person meetings, and while working from his home office).

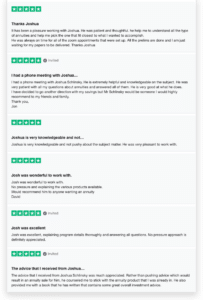

Oh, and did I mention, that Joshua receives RAVING reviews from the clients that he’s helped as you can see from these glowing reviews?:

Joshua will be sharing how he prefers a more direct approach (a novel concept of marketing and selling annuities to people who are actually looking to buy annuities).

Here are a few timestamps, in case you are short on time and need to jump to the good stuff:

- 7:25 – A look at Joshua’s background and story that led him to selling annuities virtually (way before anyone else).

- 10:55 – How a life-threatening illness changed everything in Joshua’s life and forced him to make changes in his practice.

- 11:50 – How Joshua was forced to adapt when he could no longer do seminars.

- 12:40 – What Joshua didn’t like about college preparation seminars (even though he was successful at them).

- 14:40 – What a typical day as a virtual advisor looks like (dog lovers will want to hear this).

- 17:45 – How Joshua opens his first appointment that’s different from most everyone else (but gets results).

- 20:05 – His no-pressure way to close a call that works surprisingly well at securing a second appointment.

- 20:40 – The unique way Joshua answers the question “What do you like about annuities?” to virtual clients.

- 21:55 – How Joshua explains the difference between income annuities and growth annuities to a prospect.

- 23:00 – What Joshua sends to qualified leads to build rapport, educate and close more business.

- 25:30 – The valuable resource Joshua uses to find the best annuities even when interest rates and markets change so rapidly.

- 29:05 – What tech tools Joshua uses to close business virtually (this may surprise you).

- 31:38 – The unique unbiased approach Joshua uses to put clients at ease and ensure they are getting the best annuity product for them and not for the advisor’s bottom line.

- 33:40 – How Joshua sets himself apart from other advisors and can even beat out the local advisor (most of the time).

- 37:20 – Skills Joshua has mastered that many advisors don’t have (and will cost you sales).

- 40:00 – How to define your advisor “superpower” that makes you unique and can add value to your practice over everyone else.

- 42:45 – What Joshua likes about virtual leads that he didn’t get with less direct seminar leads (if you get stuck on the phone with tire-kickers you need to hear this).

- 47:10 – Whether virtual advisors are assigned zip codes and territories.

- 49:00 – The fundamental component during a first meeting that builds rapport and the no-pressure way to get the second appointment.

- 52:40 – The simple way Joshua handles virtual leads.

- 55:00 – How much educating Joshua does with clients to get them up-to-speed on annuities.

- 57:20 – A simple question Joshua asks prospects to gauge their level of knowledge about annuities (this one tip can save you a lot of time).

And so much more!

Our interview with Joshua will provide you with winning ideas and strategies you can use in your practice right away.

When it comes to annuities, he’s a storehouse of knowledge and ideas (when he speaks, other financial advisors listen).

He is not afraid to be blunt and honest with clients and has a wealth of knowledge when it comes to annuities.

He is a master at building trust, rapport, and confidence with prospects and clients without in-person meetings.

If you’re considering college planning or joining an IUL leads program to grow your practice… you’ll want to watch this Annuity Experts livestream.

This show is packed with a wealth of knowledge you won’t want to miss.

P.S. If you’re sick and tired of “bait & switch” marketing gimmicks to get in front of more qualified prospects or having to “back-door” annuities, give us a call at (520) 639-9479 or…

Click here to book your 1:1 Discovery Call with our team

P.P.S. Let’s have a chat and see if we can help you grow your practice with just an internet connection and a cell phone, as we did with Joshua.