According to marketing experts, we’ve gone from being exposed to roughly 500 marketing advertisements and messages a day back in the 1970’s, to as many as 5,000 a day today.

Everyone from insurance carriers and financial advisors to the talking heads on CNBC are vying for our attention when it comes to financial matters. The consequence of all these conflicting marketing messages is that it creates confusion for our prospects. This is especially true when it comes to annuity sales. Things can even get more complicated when insurance companies are pushing: bonuses, caps, fees, highest ratings, income floor, income riders, and roll-up rates.

How can you be heard in this digital age amidst all the distractions and conflicting messages?

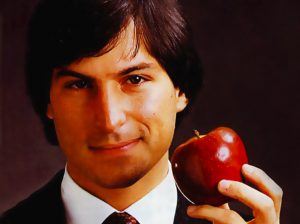

There’s a secret that I’ve stumbled upon that’s been used by industry titans like Steve Jobs, best-selling authors, and religious leaders.

Best selling author, entrepreneur and investor Robert Kiyosaki would always tell me:

“The highest paid people on the planet can take complex subjects and simplify them…”

That’s it, folks. That’s the secret to cutting through all the clutter and distractions: craft the most simplified message when communicating of how you help your clients.

Robert Kiyosaki has sold over 12 million copies of his book Rich Dad Poor Dad, because he’s been able to simplify financial education for the masses. If you read his books you’ll see how he’s able to masterfully weave stories to make financial education fun and engaging.

Robert Kiyosaki has sold over 12 million copies of his book Rich Dad Poor Dad, because he’s been able to simplify financial education for the masses. If you read his books you’ll see how he’s able to masterfully weave stories to make financial education fun and engaging.

In 2001, when portable mp3 players were just beginning to gain popularity, most companies were pushing how many Gigabytes or data storage each device could hold. Companies would claim that their mp3 players could boast 3.5 Gigs or 5 Gigs. Steve Jobs introduced the iPod by saying “1,000 songs in your pocket,” thus revolutionizing how we listen to music on portable devices today.

Let’s face it… Nobody really cares about how much memory capacity a music device holds. Consumers only care about the end result, which is having a boatload of their favorite songs to carry along with them on the go.

So when it comes to marketing and selling financial services, are you jumping on the band wagon like most advisors by hawking financial product features (ie annuity bonuses, roll-up rates, etc)…

Create a simplified message that resonates with what retirees REALLY want.

What DO retirees really want?

They want lifelong income that beats inflation and provides a safe place to keep their money from the volatile effects of the market?

Ask yourself the following 3 questions:

1) Is my message addressing my target client’s hopes, dreams, desires and fears?

2) Would the average joe prospect clearly understand how I can help them?

3) Am I showing how I can solve my client’s most burning problems clearly?

Oftentimes, financial people get so caught up in all the “distractions” or features that their financial services/products provide, and completely miss the boat when it comes to what’s REALLY most important to retirees today.

What’s most important to retirees is: securing their money from stock market volatility, ensuring they have enough income through their retirement, and ensuring their purchasing power remains intact despite rising inflation.

“A Confused Mind Always Says No.”

The more clarity that you can create for your clients, the easier it will be to close the sale.

Remember good ‘ol Zig Ziglar,

“KISS, Keep It Simple, Salesman!”